2022 was a bumpy and wild ride for most. Between the mass tech layoffs, the rise of inflation, skyrocketing interest rates, and global economic uncertainty, it’s no surprise that it was also a volatile year for the health tech market. One of the biggest trends we noticed last year was that health tech funding and deal volume took a major hit. According to CB Insights, digital health tech funding dropped 57%, and deals were down by 33%. M&A deals also decreased by 85% compared to Q4’21.

That said, 2022 wasn’t all doom and gloom for the health tech industry. We saw monster acquisitions, including the $8B Signify and CVS merger and the $3.6B OneMedical and Amazon deal. We also witnessed the rise in AI-enhanced diagnostics, wearables, and big data solutions. Plus, a handful of unicorns were born, such as Incredible Health —the first of its kind in healthcare hiring — and Transcarent, which is tackling employer-sponsored benefits.

Depending on who you ask, some think health tech spend is recession-proof, and they remain bullish for the rest of the year ahead. In contrast, others believe pumping the brakes on significant investments and additional hiring is prudent and the right posture until they have a better idea of how macroeconomic pressures shake out in 2023.

Early in the year we received a slew of questions from clients and candidates within our health tech practice asking us about broader market dynamics from a hiring and investing standpoint. In response, we surveyed 100s of top HR executives, talent leaders, and operators in the health technology space about hiring trends and market themes expected for the rest of 2023. Here’s a summary of what our survey respondents shared…

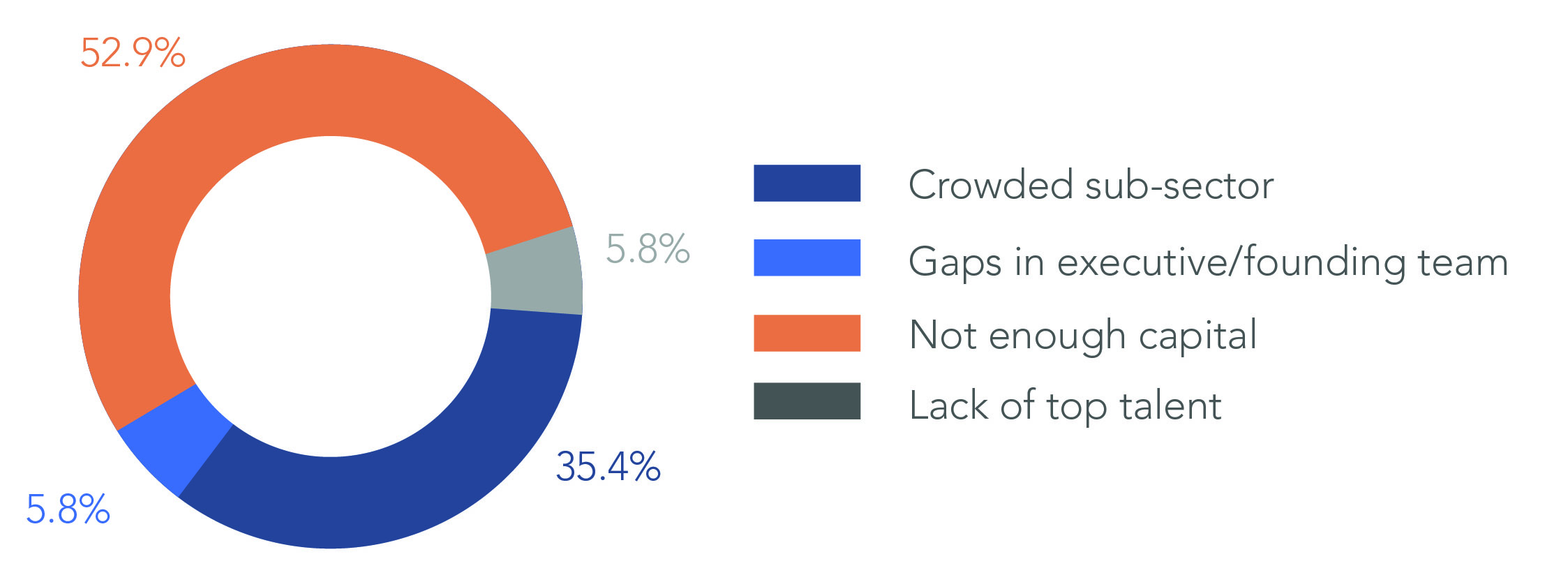

What is the biggest barrier to entry for a health tech company seeking funding in this environment?

Over half of respondents believe that the most significant barrier to entry is the sheer lack of capital. Counter-intuitively, a quarter of respondents have been directly involved in a fundraise in the past 12 months, and a third plan to fundraise in the next 12 months, so the dry powder exists.

The second highest barrier is the number of new startups entering a crowded market; for example, there are almost 100 companies in the AI radiology space alone. What will set companies apart as far as the next biggest breakthrough in healthcare?

Our take — This is no surprise to us given the drop in overall venture funding. That said, we remain bullish that the most active firms in this space (a la General Catalyst and Optum Ventures) will continue to invest in areas such as generative AI, value-based care, and mental health, especially with mega-rounds.

When it comes to entering a crowded market, subject-matter experts with clinical experience in a given sub-sector will get the farthest in investor pitches. Investors want to see demonstrability and oftentimes PhDs in their CEOs, especially in biotech plays. Direct experience in a given therapeutic area will become increasingly important.

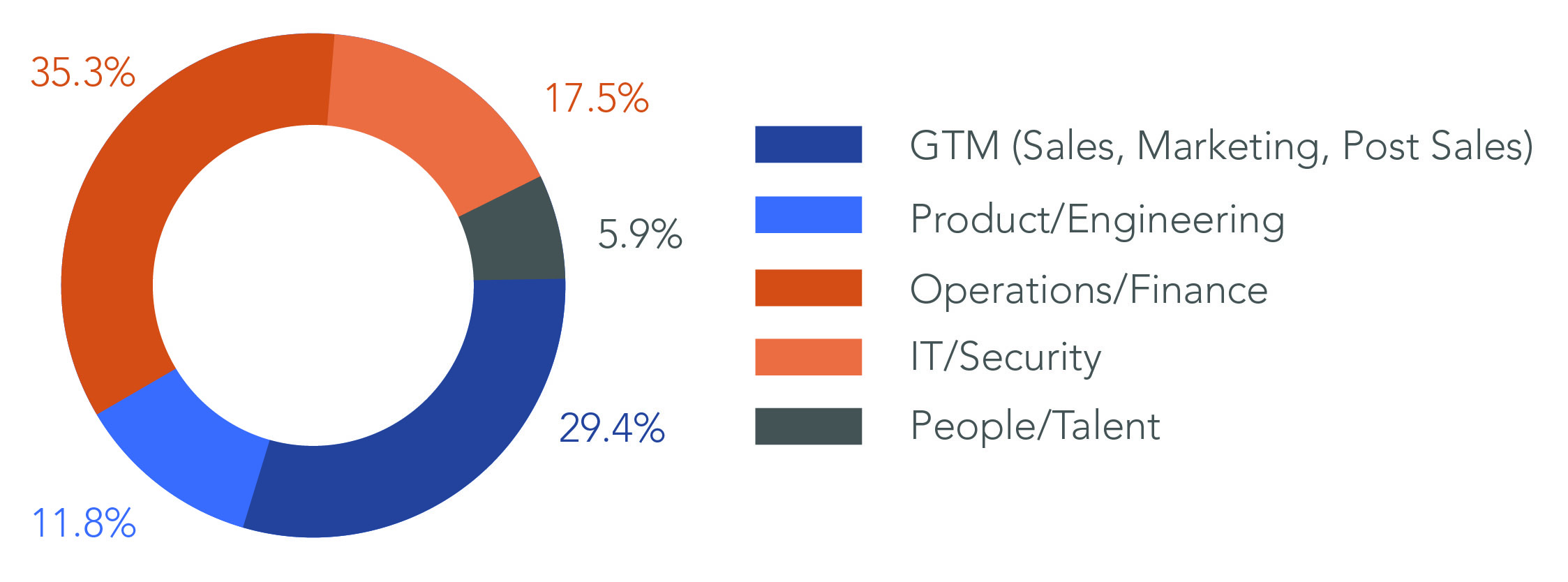

What are the talent and recruiting priorities within health tech this year?

We asked which function will be the top recruiting priority for the remainder of 2023. The number one answer was Operations & Finance, followed closely by GTM (Sales, Marketing and Customer Success). The lowest priority for the year was People/Talent.

We were also curious about where these leaders have found the best talent in the past. Over 70% of respondents have seen the highest performers have domain-relevance experience, across all functions (compared to enterprise or consumer DNA).

Our take — The prioritization of Ops & Finance is directly reflective of growth-stage companies needing to tighten up the balance sheet, while there has been less of an investment in recruiting and no longer an appetite to grow at all cost.

On the GTM talent side, we were surprised to see a lower percentage of enterprise backgrounds as the highest-performing leadership category. We have done a number of highly successful marketing leadership searches for B2B health tech companies in which we targeted enterprise SaaS backgrounds to apply demand generation metrics to a business moving upstream. That said, there will always be a quicker time to ramp for folks who have come from the same revenue-generating environment.

How do you see the landscape of health tech funding and M&A evolving this year?

According to Pitchbook data, health tech investment held up well for most of 2022 before plummeting to just $451.3 million across 43 deals in Q4—more than 75% off the average quarterly pace in 2021. These sobering statistics had many of us holding our breath for what this could mean for the M&A and funding health tech landscape into 2023.

What’s interesting is that the survey results are nearly split evenly across no change, more investment, and less investment, but on the M&A front, over 64% of respondents expect more M&A activity for this year.

Our take — This leads us to believe that while we likely won’t be experiencing skyrocketing funding rounds like we saw in 2020 and 2021, we also presumably won’t be experiencing a major halt on funding rounds either and can most likely expect 2023 to be somewhat of a steady investment year.

However, M&A is likely to remain a prominent strategy for companies looking to gain a competitive edge and position themselves for success in this dynamic sector — and there are two primary drivers worth noting:

- Demand for innovation. Health tech is a rapidly evolving field that is constantly pushing the boundaries of what is possible in healthcare. Companies are seeking to acquire innovative technologies, products, and services that can help them gain a competitive edge and stay ahead of the market.

- Consolidation and Integration: As the health tech landscape becomes increasingly crowded with a multitude of startups and smaller companies joining the conversation each year, larger companies are looking to consolidate their market share and integrate complementary technologies or services into their existing offerings. M&A can be an effective way to achieve these goals and create synergies.

Who do you anticipate acquiring the most health tech companies this year?

Over 40% of respondents believe Amazon will take the cake when it comes to acquiring the most health tech companies this year. In addition to the massive One Medical merger, Amazon has previously acquired companies in the health and wellness space, such as PillPack, an online pharmacy, and Health Navigator, a telehealth company.

Amazon has explicitly expressed interest in the healthcare sector and has been exploring opportunities to disrupt and innovate in the healthcare industry. Amazon has launched initiatives such as Amazon Care, a virtual healthcare service for employees, and has been involved in healthcare data interoperability and medical supply chain management projects.

Our take — Amazon has a history of making strategic acquisitions in various industries to expand its business and diversify its offerings, so we didn’t find the results surprising here. From the General Manager search that SPMB led within Amazon’s healthcare division, we expect that in this highly competitive landscape, Amazon will likely remain motivated to acquire more health tech companies to stay competitive and maintain its market position.

Conclusion

Our biggest takeaway is that health tech is not recession-proof. Almost half of our respondents have been with a company that has experienced a RIF in the past 12 months, which is in line with the rest of the technology sector. New companies coming to market need to be as crisp as ever on messaging and what sets them apart, while established healthcare SaaS providers need to be realistic about growth margins in this environment.

When it comes to prioritizing talent and headcount growth, we anticipate a continued need for strong GTM talent. Why? Defining and nourishing a customer base will be paramount to remaining relevant in a competitive landscape.

Solving our clients’ most challenging problems through talent acquisition has been and remains our top priority in both up and down markets. If we can help you take advantage of the current market conditions to expand or upgrade your leadership team, please reach out to the head of our health tech practice, Allison Beach, at allison@spmb.com.