In this discussion, SPMB’s artificial intelligence (AI) and machine learning (ML) search practice leaders, Todd Greenhalgh and Damon Zeligs, share their perspective on today’s booming AI industry. They talk about the macro forces driving the sector forward, the unprecedented inflow of investor interest and capital into AI, and how the industry is attracting and demanding a new breed of leadership. With over 12 years of combined search experience in AI and ML, Todd and Damon have been building executive teams at both earlier-stage AI startups and companies at scale that are blazing the way in AI innovations.

Todd, you’ve spent nearly a decade recruiting talent into companies architecting AI and ML capabilities. Can you provide a high-level overview of how the industry has evolved and where we are today?

Todd: My earliest work in AI began with building leadership teams selling software solutions to legacy energy companies — utilities first, followed by oil & gas — many of which were early AI adopters. Decarbonization of power generation (i.e., wind, solar) combined with smart metering allowed utilities to derive data from sensors and to balance this demand with more intelligent, cleaner generation and distribution of energy.

From there, AI quickly evolved and broadened into other sectors like government, defense, financial services and industrials prompting new, more sophisticated applications to emerge. These next-gen AI applications could leverage ubiquitous data sources (well beyond sensors and devices), and allow organizations on the bleeding edge of AI innovation to capture and process data in ways and at speeds not previously imaginable. During this period of rapid innovation and progress, we saw computing speed increase, computing costs come down, and the ability to aggregate and exploit massive data pools from different sources in order to derive instructive business insights.

Today, AI capabilities incorporate human domain knowledge — meaning that some technologies can reason and make choices like humans. By injecting human expertise and causality into these networks as pre-training, they’re able to achieve more robust data sets and greater outcomes. With all of these advancements now in play, AI adoption has become a determining factor in the future success and relevancy of some of the world’s largest, most established organizations. Legacy industries are furiously deploying resources and capital, and acquiring top talent to stay ahead of the AI curve and remain relevant, competitive and profitable. So, what exactly are companies trying to achieve with AI? At a high level, the objectives include:

- Use their organization’s data capture to make real-time business inferences;

- Harness the power of the IoT to make every device a computer that can monitor‚ interpret and react to conditions instantly and make anticipatory decisions; and

- Apply the latest in AI to solve problems previously deemed unsolvable (i.e., manufacturing optimization, fraud detection, anticipation of equipment failures).

There are a few converging events driving the increased interest in AI and ML — COVID-19 being one of them. The pandemic helped show organizations the benefits of automation and how it could turn cost-draining, “problem” areas of their businesses into value drivers. So, after years of failed AI deployment by many enterprises, there are now more operational use cases that demonstrate its potential. Companies that were once hesitant to move to the cloud are now rushing to play catch up to rivals, and this competition is propelling the next-gen strategies around how to use AI (and all that stored data) to drive operational gain.

Damon, how have you seen the investment community respond to and harness the AI opportunity in the past few years, and more recently in the past 12-18 months?

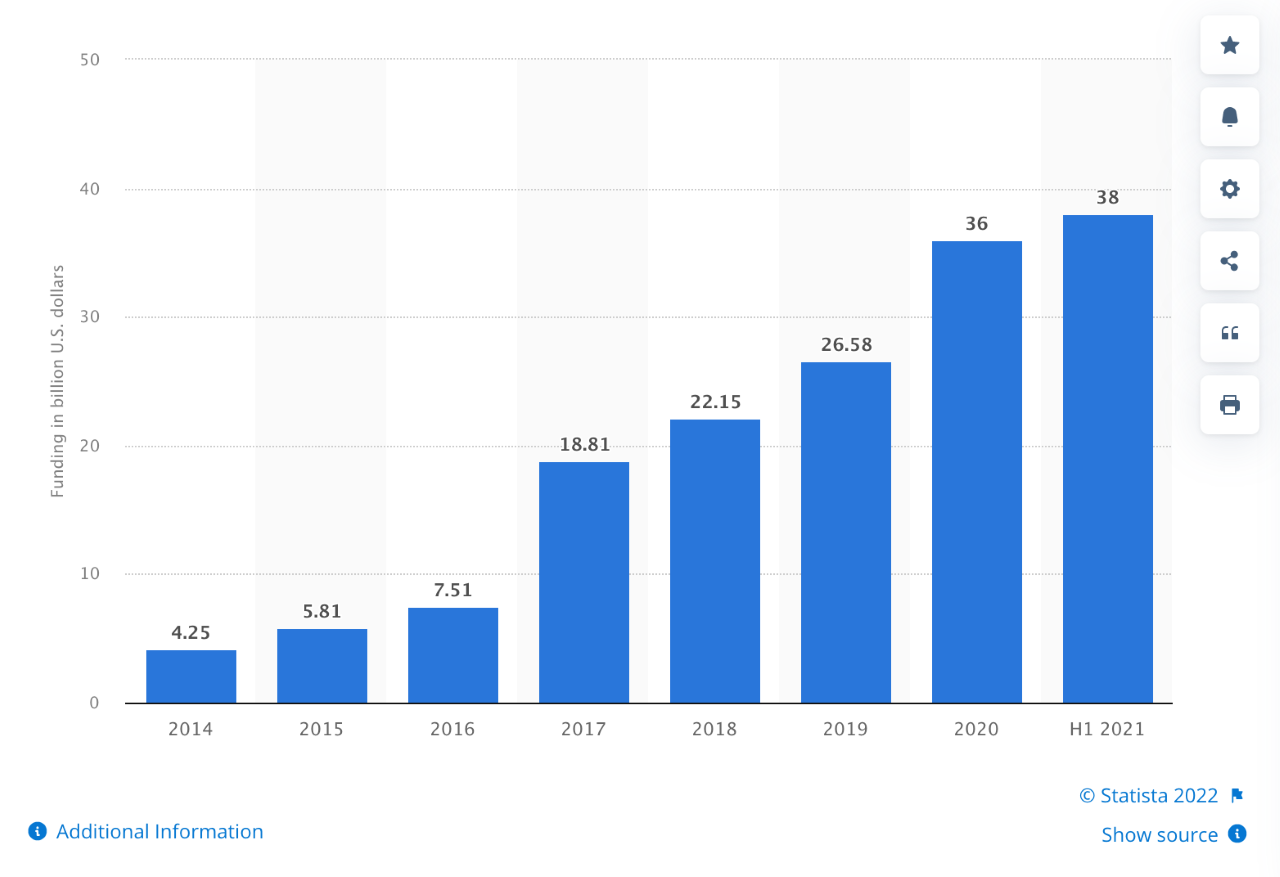

Damon: The venture community tends to forerun general investment trends and the chart below shows the massive amount of startup funding that’s been funneled into AI globally since 2014 — and how it continues to climb year after year.

Funding of artificial intelligence (AI) startup companies worldwide from 2014 to 2021

(in billion U.S. dollars)

Source: Statista

And in the past year, AI venture funding set a third consecutive quarterly record in Q2 2021, with $31.6 billion invested in the vertical. That number includes 11 deals that closed at more than $500 million and 13 IPOs (Pitchbook). That’s pretty astonishing and the runway for growth is virtually boundless.

So while there are fewer AI customers today, the deals are bigger, the growth is faster and the revenues are larger — and this momentum will only continue. As a result, we’ve seen a real focus and commitment from venture firms that are funding and supporting the growth of AI companies trying to solve some of the world’s hardest technical challenges — and equally, capture the profitability upside. Among those investors dedicated to AI innovation and growth are Amplify Partners, TPG Growth, NewView Capital, Lux Capital, Y Combinator, Insight Partners and Sequoia Capital — to name a few.

As AI-driven projects increasingly garner a substantial percentage of any company’s technology investment and stimulate the growth of the global economy, we’ll continue to see massive investment into the sector and growing competition for the talent that helps drive both early- and later-stage companies forward.

On the topic of talent, what does it take to be successful in AI? Are there unique qualities or profiles that you look for in the executives you’re placing in this space?

Todd: What’s most exciting about the AI talent ecosystem is that it has and continues to attract some of the world’s most brilliant minds — including proven entrepreneurs, savvy investors, celebrated professors and next-gen visionaries. These are the individuals who are not only architecting this sector, but also building the high-performance leadership teams that are tasked with staying ahead of AI’s evolving demands.

Damon: I’d also highlight that successful AI leaders today must be multi-faceted, multi-disciplined executives that have hybrid expertise across various functional areas. For instance, in the go-to-market (GTM) work I do for my AI clients, the roles consistently require a new type of GTM profile, especially for CRO and VP sales roles. AI is not enterprise tech — it’s not like selling another legacy ERP system. This sales leader has to be very nuanced about approaching the entire go-to-market stack. We have our direct selling motion with our traditional AI, but then we have a very modern sales engineer type of role. So, it’s this technical leader who’s seen enterprise sales, but also knows the new tech ecosystem stack. Executives who are able to master these hybrid expertise are a rare breed and tend to be the most successful and sought-after AI leaders today.

Todd: There’s also a different, more complex selling motion. AI is being sold to both the business and the technology organization, focusing on business outcomes. It requires a technical understanding of what the product does and what problems it can solve. It also requires leaders to really identify exactly where AI is going to have the most significant impact and business outcomes, it is a very consultative sale by its very nature. Not to mention, each one of the vertical markets that AI is deployed on has a completely different business case, vernacular, cost or risk drivers that are pertinent to the particular, go-to-market motion of the company. To deeply understand and command all of these elements requires real sector knowledge and business acumen.

But above all, AI leadership demands a truly consultative approach. It requires first understanding and then solving your clients’ most significant problems.

What’s been the biggest challenge for legacy industries that are trying to pursue and implement AI capabilities?

Todd: I’d say it’s how organizations are pursuing AI and digital transformation. It comes down to a fundamental decision to build or buy — meaning pursuing an in-house approach (build), versus leveraging outsourced AI capabilities (buy). A lot of Fortune 500 companies have and will continue to build AI capabilities in-house, but it’s often challenging for them. It requires a lot of investment in software development, which may not necessarily be a core competency. It also requires developing tool sets that are rarely configurable across the board. Whereas many of our clients are trying to sell AI solutions into these companies once they’ve struggled and/or failed with an in-house approach. I anticipate that this ‘do it yourself’ versus buying external capabilities conundrum will remain a “make or break” decision for large legacy companies trying to achieve digital transformation and remain competitive.

Damon: As we dive deeper into the 21st century, getting AI “right” has the potential to help solve organizations’ business problems and increase their revenue while decreasing costs. On the flip side, getting it wrong or resisting adoption of these new technologies could make a once well-established company disappear. The stakes are high and only increasing each year. Early adopters have an opportunity to reshape their industry and how it operates, while AI laggards will be forced to invest heavily to play catch up, or quickly fall behind and suffer those consequences.

In your view, what are the top industry verticals that are both propelling and benefiting most from AI? Within those verticals, can you provide an example of AI disruptors to watch?

Todd and Damon: The industries below stand to gain exceptional benefits by integrating AI into their business processes — and they’ll be really exciting to follow over the next 3-5 years. These categories are broad and there are countless subcategories within, but at a high level, we anticipate these sectors will become hugely disruptive as they harness and implement the full potential and growing power of AI.

#1 | GOVERNMENT & DEFENSE

Why: The human workforce cannot manually process large amounts of data, particularly the massive sets collected by the military, aerospace, IRS and other government sectors. However, AI completes time-consuming — and tedious — tasks quickly and accurately. Machine learning and deep learning, in particular, excel at tasks that are clearly defined, involve massive amounts of data, and require extensive repetition.

Market Leaders To Watch:

C3.ai — “C3 Government Applications” were developed to enable defense and civilian agencies to rapidly address their priority goals by unifying data across systems, generating AI-based predictive insights at scale, and transforming existing operations. Each C3.ai Application has been proven at-scale and provides a way to rapidly deliver substantial value to its stakeholders. Use case examples include: AI Readiness; Fraud Detection; Anti-Money Laundering; Workforce Analytics; Intelligence Analysis; and Data Fusion.

ForAllSecure — Utilizing patented technology from a decade of research at Carnegie Mellon, ForAllSecure brings truly automated intelligence into application security testing, paving the way for autonomous technology that will allow organizations to stay ahead of attackers by automatically detecting and validating code defects without any human intervention.

Primer.ai helps organizations make the best use of their investment in data by using best-in-class machine learning and natural language processing technologies to help customers scale and optimize their intelligence workflows. Often deployed in high-security environments—government agencies, financial institutions, Fortune 50 companies—Primer’s systems are continuously monitored, pressure-tested and secure.

#2 | ENERGY (traditional and renewables)

Why: The scale and cost of decarbonizing the global energy system remain gigantic, and time is running out. However, next-gen digital technologies like AI can be adopted more quickly and at larger scales to enable the energy transition. AI use cases include improving energy efficiency, reducing dependence on fossil fuels, and optimizing processes to aid productivity.

Market Leaders To Watch:

BakerHughesC3.ai (BHC3) is a strategic alliance that brings together Baker Hughes’ energy technology expertise with C3.ai’s unique AI software to enable digital transformation of the oil and gas industry. The BHC3™ AI Suite is a platform to build, deploy and operate enterprise-scale AI applications — and deliver predictive intelligence that helps oil and gas businesses deliver safer, cleaner and more sustainable energy.

Validere is transforming the world’s largest supply chain — oil & gas — to be commercially and environmentally efficient. How? By tracking each molecule from the ground through final delivery, providing a clear path to boost efficiency, improve margins, and lower carbon emissions.

#3 | FINANCE, BANKING & INSURANCE

Why: Every day, huge quantities of digital transactions take place as users move money, pay bills, deposit checks, and trade stocks via online accounts and smartphone apps. The need to ramp up cybersecurity and fraud detection efforts is now a necessity for any bank or financial institution, and AI is playing a key role in improving the security of online finance.

Market Leaders To Watch:

Vectra AI‘s platform automates threat detection, reveals hidden attackers specifically targeting financial institutions, accelerates investigations after incidents, and even identifies compromised information.

Zesty.ai uses artificial intelligence to understand the impact of climate risk to each and every building. In fact, Zesty’s property intelligence products allow insurance companies to evaluate each home — not just the zip code.

#4 | MANUFACTURING & SUPPLY CHAIN

Why: AI and ML are already changing the face of the manufacturing and supply chain industries by spotlighting deep-rooted inefficiencies. How? By driving enterprise-wide visibility into all aspects of the supply chain with precision that humans cannot mirror at scale. AI is helping to deliver the powerful optimization capabilities required in supply chains for more accurate capacity planning, improved productivity, lower costs, higher quality, and greater output, all while promoting safer working conditions.

Market Leader To Watch:

Stovell AI Systems — Stovell AI delivers pricing & demand forecast solutions to leading corporations with complex value chains that are looking to harness the power of machine learning technologies to build next-gen solutions for dynamic marketplaces. Fortune 500 companies rely on Stovell AI Systems to forecast customer demand with radically improved accuracy.

For organizations looking to hire AI leaders or just beginning to learn more about the industry, what guidance can you share?

Todd: There’s a massive market opportunity in front of us and we’re excited to be at the forefront of it helping organizations shape AI leadership that will drive the sector forward responsibly. AI is here whether “we” like it or not, so identifying and placing the right industry stewards through talent recruitment is a role we value and take very seriously.

Damon: It’s hard to overstate the astronomical growth that AI is experiencing with new entrants coming to market at an astonishing rate. As a result, the demand for experienced leadership is on the rise and increasingly difficult to find. SPMB has been working in this industry since its very beginning and building relationships with the leaders who are driving AI forward. We’ve mapped the talent ecosystem and we know where to mine for next-gen leaders. So, if you’re looking to add executives to your AI organization, reach out to us to start the conversation.

We’ve also included a list of our favorite AI publications and newsletters below — let us know if you have any additional recommendations!

AI Resource Library:

- Digital Transformation: Survive and Thrive in an Era of Mass Extinction

- WSJ Pro Artificial Intelligence

- Fortune’s Eye on A.I. Newsletter

- AI Magazine

- Last Week in AI

- VentureBeat AI Weekly

- The Batch: Weekly AI news for engineers, executives, and enthusiasts

ABOUT THE AUTHORS:

Todd Greenhalgh

Todd, a veteran AI search practitioner, started working in this space before it was called AI. His experience dates back to the start of his now 9-year working relationship with C3.ai, helping the organization architect its GTM leadership team from C3’s infancy to pre- and post-IPO. Todd has worked alongside some of the earliest AI adopters and visionaries — from both the investment and client side. With AI technology advancing dramatically over the last decade, Todd has remained in lockstep with the industry’s pioneers, helping them scale their organizations and drive their AI capabilities forward through talent acquisition.

Damon Zeligs

As the AI industry has ascended furiously over the past 3 years and seen a massive infusion of investor capital, Damon has partnered with some of the world’s most exciting and promising AI startups. Among this group of AI innovators are Veryfi (real-time data extraction from receipts, invoices and financial documents), Validere (digitally transforming the world’s largest supply chain — oil & gas — to be more sustainable and efficient) and Stovell AI Systems (market-focused machine learning techniques, systems, and algorithms to develop predictive solutions). While these companies and their technologies may not yet be mainstream, we anticipate that changing in the next 3-5 years.